28 Jan Prepaid Expenses Journal, Asset, Expense, and Examples

It reflects a future economic advantage for the insured party by providing protection against potential losses or obligations. Prepaid insurance is first recorded as an asset on the balance sheet because the coverage is for a future point in time. In this scenario, we would record a prepaid asset at the beginning of the contract and the expense of the subscription would be realized over the course of the year. This would achieve the matching principle goal of recognizing the expense over the life of the subscription. Accrued expenses, such as accrued rent, are the result of receiving a service or goods before payment is made. As a rule of thumb, prepaid expenses have been paid but are yet to be realized whereas accrued expenses are incurred but yet to be paid.

Why would Prepaid Insurance have a credit balance?

A “prepaid asset” is the result of a prepaid expense being recorded on the balance sheet. Prepaid expenses result from one party paying in advance for a service yet to be performed or an asset yet to be delivered. Accounting for prepaid expenditures and ensuring they are properly recognized on your financial statements is a critical piece of financial reporting. In this article, we will delve further into how to appropriately account for prepaid expenses and their impact on the financial statements as well as decision-making. On July 1, the company receives a premium refund of $120 from the insurance company.

Prepaid Expenses

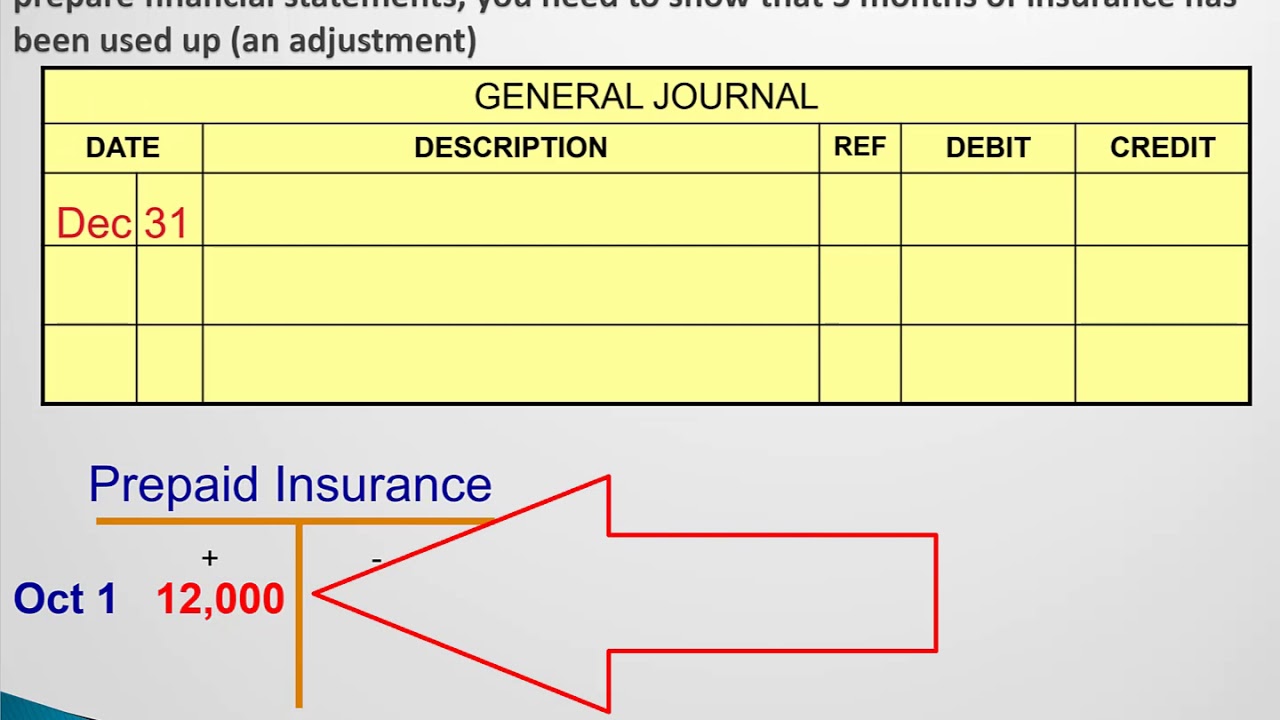

- They do not record new business transactions but simply adjust previously recorded transactions.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- FastTrack company buys one-year insurance for its delivery truck and pays $1200 for the same on December 1, 2017.

- Prepaid insurance is important because a business should correctly record all of its transactions and resources to have accurate financial statements.

- According to generally accepted accounting principles (GAAP), expenses should be recorded in the same accounting period as the benefit generated from the related asset.

Assume that on December 1, a newly formed company pays $600 for insurance coverage for the six months ending on June 1. As of December 31, the company will report Insurance Expense of $100 and its current asset Prepaid Insurance will report $500. The prepaid amount informs is prepaid insurance a contra asset the readers of the December 31 balance sheet that the company will not have to pay $500 in cash for insurance during the next five months. Although prepaid expenses are initially recorded as assets, their value is expensed over time onto the income statement.

Which of these is most important for your financial advisor to have?

As mentioned above, the premiums or payment is recorded in one accounting period, but the contract isn’t in effect until a future period. A prepaid expense is carried on an insurance company’s balance sheet as a current asset until it is consumed. That’s because most prepaid assets are consumed within a few months of being recorded. Prepaid insurance is usually charged to expense on a straight-line basis over the term of the related insurance contract.

If the prepayment covers a longer period, then classify the portion of the prepaid insurance that will not be charged to expense within one year as a long-term asset. Prepaid insurance is commonly recorded, because insurance providers prefer to bill insurance in advance. If a business were to pay late, it would be at risk of having its insurance coverage terminated. In this example, let’s assume we purchase a 12-month cyber insurance policy for $1,800 on January 1st, 2023. The term of the policy is only 12 months, therefore we will not recognize any long-term prepaid asset. To recognize the expense of the policy evenly over the policy term, divide the total policy amount of $1,800 by 12 for a monthly insurance premium expense of $150.

Example of a Credit Balance in Prepaid Insurance

The trial balance, drawn up on 31 December 2019, assumed that he had no other insurance and his insurance expenses account would show a balance of $4,800. Deferred revenue should be recorded as an asset and classified as a current asset if it is expected to be realized in the next 12 months. If it is not expected to be realized in the next 12 months, it should be classified as a long-term asset. In this case, Prepaid Insurance is classified as current assets on the Balance Sheet, as shown below.

As the coverage term progresses and sections of the prepaid insurance are expensed, the prepaid insurance account is credited to reflect the decrease in the prepaid amount. Now if this were a short-term lease, then a prepaid asset would be recognized on the balance sheet for prepaid rent expense. However, under the new lease accounting pronouncements, the guidance eliminates recognizing prepaid assets on the balance sheet related to leases exceeding a total lease term of 12 months. Rather, any prepaid rent pertaining to a long-term lease would be rolled into the ROU asset balance recognized on the balance sheet.

The full value of the prepaid insurance is recorded as a debit to the asset account and as a credit to the cash account. Each month, as a portion of the prepaid premiums are applied, an adjusting journal entry is made as a credit to the asset account and as a debit to the insurance expense account. From a financial accounting perspective, prepaid insurance is considered a prepayment. Recorded as a current asset on the balance sheet, it is progressively accounted for on the income statement as expenses, reflecting the utilization of insurance coverage in each accounting period.